Securing your financial/monetary/economic future after retirement is a crucial/essential/vital aspect of life planning/future preparation/personal strategy. Australians have various options/choices/avenues available to ensure/guarantee/provide a comfortable and financially secure/stable/independent retirement.

To get started, consider/explore/evaluate these key steps/stages/phases:

* Define/Establish/Determine your retirement goals/aspirations/visions. What kind of lifestyle/standard of living/daily routine do you envision?

* Assess/Evaluate/Calculate your current financial situation/assets/position. Howmuch wealth/capital/savings have you accumulated/gathered/built up?

* Develop/Create/Formulate a comprehensive/detailed/thorough retirement plan/strategy/blueprint. Incorporate/Include/Factor in your expected expenses/living costs/future outgoings and investment/growth/return {expectations/.

* Explore/Investigate/Research different retirement savings options/vehicles/schemes, such as superannuation/defined benefit plans/pension funds.

* Seek/Consult/Engage with a financial advisor/planner/consultant to receive/gain/benefit from personalized guidance/advice/recommendations.

Regularly review/monitor/update your retirement plan/strategy/blueprint to reflect/adjust/accommodate any changes/shifts/developments in your circumstances/situation/life. By following/implementing/adhering to these steps/guidelines/principles, you can maximize/optimize/enhance your chances of a comfortable/secure/fulfilled retirement in Australia.

Fortifying Your Financial Future in Australia

Planning for your financial future is a crucial step, and in Australia, there are diverse options available to help you achieve your objectives. A solid platform starts with establishing a spending plan that tracks your income and expenditures.

Consider investing in diverse avenues such as shares, superannuation, or land. It's also significant to review your protection needs and ensure you have adequate cover for unforeseen events. Remember, a proactive approach to your finances can help ensure a brighter future for yourself and your loved ones.

Key Financial Steps for Aussie Citizens

Crafting a solid financial plan is crucial for any Aussie. It doesn't matter your age or financial situation, having a clear understanding of your aspirations and developing a plan to achieve them can bring you peace of mind.

A great initial action is to analyse your current status. This involves recording your income and spending. Once you have a solid grasp of where your money is going, you can start to pinpoint areas where you can save.

Also, it's crucial to establish objectives. These could include anything from buying a home, retiring comfortably, or simply accumulating an emergency fund. Bear this in mind that your goals should be well-defined.

Finally, reach out to a specialist. A qualified planner can provide personalized guidance based on your specific situation.

Australian Retirement Savings

Superannuation is a type of mandatory fund in Australia. It's essentially funds collected by both employers and employees. This pooled money then is invested to support your lifestyle once you stop working.

Everyone who works in Australia are automatically enrolled in a superannuation scheme, meaning your employer makes regular contributions on your behalf. You can also make voluntary contributions to increase your savings.

When you reach retirement age, you can withdraw your funds to enjoy a more comfortable lifestyle. Different strategies exist for managing your superannuation once retired, so it's important to plan your retirement goals and talk to a professional.

Navigating Retirement Income Streams in Australia

Planning for retirement is essential in Australia. It involves carefully considering your monetary situation and determining the best income streams to guarantee a comfortable lifestyle during your golden years.

Multiple factors influence your retirement income needs, including your way of life, health forecasts, and desired level of spending. Understanding these factors is essential to developing a personalized retirement income plan.

Common retirement income sources in Australia encompass the Age Pension, superannuation, private savings, and part-time work. Exploring each of these options carefully is vital to enhance your retirement revenue. It's also recommended to consult professional financial advice to help you traverse the complexities of retirement income planning.

Financial Planning Strategies for Australians

Navigating the landscape of wealth management can feel daunting, especially for Australians with unique circumstances. A well-structured approach is essential to maximise your financial standing. It's crucial to speak with a qualified financial advisor who focuses in domestic conditions.

They can assist you in developing a personalised plan that addresses your specific aspirations, whether it's retirement planning.

A comprehensive strategy often includes a range of instruments:

* Investment Allocation: Diversifying your funds across various asset classes to reduce risk.

* Superannuation: Maximising your superannuation to ensure a comfortable later life.

* Estate Planning: Establishing a plan for the distribution of your assets after your passing.

It's always too early to initiate thinking about wealth management. By consciously handling these considerations now, you can position yourself for a more comfortable financial outlook.

Reaching Financial Independence in Australia

Australia's strong economy presents a great opportunity to achieve financial independence. By developing solid financial habits and strategically investing your funds, you can secure a future of financial freedom. Start by crafting a budget that analyses your expenditures. Research various asset options, such as equities, bonds, and land. It's also essential to spread your investments to minimize risk. By following these strategies, you can aim towards achieving financial independence in Australia.

Locating The Best Financial Planners in Australia: A Match Made For You

Navigating the world of personal finance can be for many Australians. With so many financial planners available, identifying the right one to assist your investment aspirations is crucial.

Here's some key factors to help click here you in locating the perfect financial planner to meet your requirements.

* **Credentials and Experience:**

Consider planners with established credentials like Certified Financial Planner (CFP) designations. Experience is also highly relevant when choosing a planner.

* **Communication Style:**

Select a planner with whom you can comfortably communicate clearly and thoroughly.

* **Fee Structure:** Understand your potential planner charges. Typical fee arrangements encompass hourly rates, a fixed fee, or a percentage of assets under management (AUM).

* **Personal Fit:** Ultimately, the most suitable advisor for you is someone who you connect with. Schedule consultations with making a decision.

Building a Comprehensive Financial Plan

A solid financial plan is essential for achieving your financial goals. It outlines your current financial standing and sets clear targets for the future. Formulating a plan demands a thorough evaluation of your earnings, outgoings, holdings, and obligations.

- Additionally, it includes strategies for accumulating wealth, maximizing your assets, and regulating your vulnerability. A well-crafted financial plan provides a framework for achieving your dreams and guaranteeing your economic well-being.

Securing Your Wealth: Insurance and Estate Planning in Australia

When it comes to securing your wealth, insurance and estate planning are vital tools in Australia. A comprehensive insurance strategy can defend you from unforeseen financial burdens resulting from injury, property damage, or liability. Estate planning, on the other hand, involves structuring your wills to ensure that your assets are allocated according to your intents. Consulting a qualified financial advisor can help you build a tailored plan that accommodates your unique needs and goals.

Investing for Growth: Australian Markets & Portfolio Diversification

Australia's vibrant economy presents numerous opportunities for growth-oriented investors. A well-diversified portfolio that incorporates investment to the domestic market can potentially enhance returns while mitigating risk.

Key sectors to consider include resources, which are showcasing strong growth trends. {However, investors should exercise caution and conduct thorough research before committing funds. It's crucial to understand the risks associated with each asset class and tailor your portfolio to your individual investment goals.

- Consider consulting with a qualified financial advisor who can provide personalized guidance based on your circumstances.

- Stay informed about market conditions and economic developments that may influence investment decisions.

- Regularly review your portfolio performance and make adjustments as needed to ensure it aligns with your goals.

Smart Money Moves for Retirees in Australia

Planning your finances in retirement is vital to ensuring a comfortable and enjoyable lifestyle. Australian retirees face specific challenges, making it necessary to make smart financial decisions. Here are some top tips to help you maximize your retirement income and safeguard your financial future:

* Regularly review your budget and spending habits.

* Consider different superannuation options and choose a strategy that best suits your needs.

* Leverage government benefits and concessions available to retirees in Australia.

Balance your investment portfolio to mitigate risk and potentially enhance returns.

* Seek professional advice from a qualified financial planner who specializes in retirement planning.

Remember, it's never too early or late to start thinking about your retirement finances. By adopting smart money moves, you can establish a secure and fulfilling future.

Australian Tax Strategies: Getting the Most Back

Australians can/should/ought to carefully/strategically/proactively plan their taxes to minimise/reduce/lower their tax liability/burden/exposure. A well-thought-out plan/strategy/approach can unlock/release/generate significant savings/returns/benefits. With the Australian tax system being complex/intricate/nuanced, it's crucial/important/essential to stay informed/keep up-to-date/be aware of the latest rules/regulations/amendments. By exploiting/leveraging/utilizing available deductions/tax breaks/offsets, Australians can potentially/may be able to/have the opportunity to enhance/increase/maximize their after-tax income/financial well-being/bottom line.

- Consider/Explore/Evaluate contributions/donations/charitable giving to superannuation funds as a way to reduce/mitigate/lower your taxable income.

- Claim/Utilize/Apply for all eligible/applicable/legitimate deductions related to work expenses/business costs/investments.

- Seek/Consult/Engage with a qualified tax advisor/professional/expert who can provide personalized/tailored/specific advice based on your individual circumstances/unique situation/personal profile.

Exploring the Australian Share Market

The Australian share market, frequently dubbed the ASX, is a bustling marketplace in which investors can trade shares in publicly listed companies. Grasping this market requires a firm base of its framework. Investors should learn about key concepts including market indices, share prices, and multiple investment methods.

- Moreover, it's vital to monitor current market fluctuations.

- Researching individual companies and their financial performance is highly significant.

- Finally, consulting professional counsel can prove helpful for navigating the complexities of the Australian share market.

Real Estate Investment Plans in Australia

Navigating the Great Australian property market can be a daunting endeavor. Whether you're a seasoned investor looking to build wealth or simply seeking a secure investment, understanding the diverse strategies available is crucial. A popular method for Australians is investing in established properties in growth locations. These areas often offer strong rental yields and the potential for capital appreciation. However, don't overlook the advantages of considering off-the-plan properties. New builds can come with warranties, modern amenities, and a fresh start.

- Prior to diving into any property investment, it's essential to carry out thorough market analysis. Analyze your budget and determine the type of property that best aligns with your goals.

- Seek with experienced property professionals who understand the local market. Their insights can be invaluable in guiding you through the challenges of property acquisition.

- Investigate a range of financing options, including funding. Evaluate different lenders to secure the best conditions for your needs.

Passing the Torch: Small Business Succession Planning

Planning for the long-term goals of a enterprise is a important aspect of its prosperity. In Australia, where entrepreneurship are the backbone of the economy, strategic succession planning is essential to ensure the future stability of these companies.

Comprehensive succession plan considers various aspects, including ownership transfer, operational continuity, and financial planning. It in addition helps to reduce turmoil during the transition process, ensuring a smooth handover of responsibilities.

Business Owners are recommended to develop a succession plan early on to guarantee the future prosperity of their businesses. Consulting with legal experts can provide valuable assistance in navigating the complexities of succession planning.

Budgeting Basics for Young Australians

Young citizens are facing a complex financial landscape. Learning about money early on can help them make smart decisions and build a secure future.

Here's important to understand concepts like budgeting. Building good financial habits now can make a difference down the road.

Young people should explore different resources available to them, such as loans. Getting advice from trusted sources, like parents, teachers or financial counselors, can also be valuable.

By taking the time to learn about financial planning, young Australians can gain control of their well-being.

Budgeting & Saving Tips for Aussies

Saving moolah can feel tough, especially when you're juggling bills and spoiling yourself. But don't worry, there are plenty of handy tips and tricks to help Aussie shoppers get their finances in order. First, draft a sensible budget that tracks your income and expenses. Look for areas where you can trim costs. Maybe swap those expensive lattes for your own brew or find cheaper options for your eats. Next, set savings goals and schedule regular transfers to your piggy bank. Remember, even small contributions can grow over time. Don't be afraid to hunt for deals and utilise discounts and offers. By following these budgeting tips, you can manage your money and reach your aspirations.

- Examine your bank statements regularly to spot areas where you can save

- Haggle with service providers for lower rates on bills

- Consider alternative transportation options like public transport to reduce on fuel costs

Your Complete Guide to Financial Planning in Australia

Navigating the world of finances can be daunting, especially for those residing in Australia. Our complex economic structure requires a calculated approach to ensure long-term financial stability. This ultimate guide will offer essential steps and insights to help you seamlessly plan your finances in Australia.

- To begin with, it's important to determine your current financial standing. This includes examining your income, expenses, assets, and liabilities.

- Subsequently, set clear objectives. Whether it's saving for a mortgage, planning for retirement, or expanding your wealth, define your milestones.

- Furthermore, investigate different financial products available in Australia. Consider factors like risk tolerance, return potential, and time horizon.

Keep in mind that financial planning is an ongoing process. Periodically re-evaluate your plan to accommodate changes in your circumstances and the broader economic environment.

Retirement Countdown: Preparing for Life After Work

As you approach this new phase, it's crucial to chart a course for life beyond your career. This milestone marks a chapter of new possibilities and adjustments. Start by examining your financial situation, clarifying your desires for retirement, and considering paths to guarantee a joyous lifestyle.

- Craft a spending strategy tailored to your requirements in retirement.

- Evaluate medical needs options for aging.

- Review your beneficiary designations.

Remember, retirement is not a sudden pause, but a continual process. Enjoy this exciting chapter and capitalize on all that life has to offer.

Michael Oliver Then & Now!

Michael Oliver Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now! Justine Bateman Then & Now!

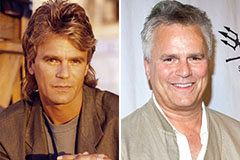

Justine Bateman Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!